Innovative Solutions

Crypto Investment Strategies: Balancing Rewards and Risks

Introduction to Crypto Investment Strategies

The world of cryptocurrency is constantly evolving, offering a wide range of investment strategies suited to different risk profiles. Whether you’re a long-term investor or an active trader, each approach has its own benefits and challenges.

It’s crucial to understand the risks associated with each strategy and to choose one that aligns with your financial goals.

In this section, we’ll guide you through the most popular investment strategies, providing a clear analysis of the rewards and risks involved, helping you make informed decisions as you navigate the crypto market.

Crypto Investment

Trading Strategies

Long-term Investing

HODLing is a long-term strategy where investors buy and hold cryptocurrencies, ignoring short-term market fluctuations.

Why HODL?

This approach is based on the belief that, over time, a cryptocurrency’s value will rise. It’s a low-stress strategy with minimal decision-making, allowing investors to benefit from the market’s overall growth.

Short-term Trading

Short-term trading involves buying and selling cryptocurrencies within a short period, often within the same day, to profit from price fluctuations.

Why Try Short-term Trading?

This strategy aims to take advantage of quick market movements, requiring active decision-making and a good understanding of market trends. While it can be profitable, it carries higher risks due to market volatility.

Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future price movements in the market.

Why Use Technical Analysis?

By analyzing patterns, trends, and historical data, traders can make informed decisions about when to buy or sell. Key indicators like moving averages, RSI, and support/resistance levels help identify market trends and potential opportunities.

Swing Trading

Traders aim to buy low and sell high within these shorter time frames, capturing gains from market movements.

Why Try Swing Trading?

This strategy strikes a balance between long-term investing and short-term trading. It requires less frequent monitoring than day trading but still allows traders to take advantage of market trends, offering potential profits with moderate risk.

Crypto Trading Strategies:

Risk vs Reward Analysis

- Most favorable Risk/Reward Ratio: Swing Trading (1.60), as it balances potential gains and risk management.

- Least risky strategy: Long-term Investing, suitable for less experienced or risk-averse investors.

- Riskiest strategy: Short-term Trading, although highly lucrative for experienced traders.

Earning with Crypto

Strategies for Profit Generation

Staking

Staking is a way to earn rewards by holding your cryptocurrency in a special wallet. When you stake your coins, you help keep the network secure and process transactions.

In return, you earn more coins as a reward. It’s like putting your money in a savings account and earning interest, but with crypto. Some popular cryptocurrencies that allow staking are Ethereum 2.0, Cardano, and Polkadot.

Yield Farming

Yield farming is another way to earn with crypto, but it’s a bit more active. It involves lending your cryptocurrency to platforms or protocols, which then use your coins to provide services like loans or trading.

In return, you earn rewards, often in the form of more crypto. Platforms like Uniswap or Aave are examples where you can participate in yield farming.

Liquidity Pools

A liquidity pool is like a pool of money that helps decentralized exchanges (DEXs) work smoothly.

By adding your cryptocurrency to the pool, you help others buy and sell coins on these exchanges.

In return, you earn a share of the fees collected from transactions.

It’s a way to support the crypto ecosystem while earning passive income.

New Strategy: Lending

Crypto lending lets you lend your coins to others in exchange for interest payments..

You can use platforms to lend your crypto, and earn interest like a traditional bank loan, but with higher returns.

This strategy allows you to put your crypto to work, generating extra income without having to sell your assets..

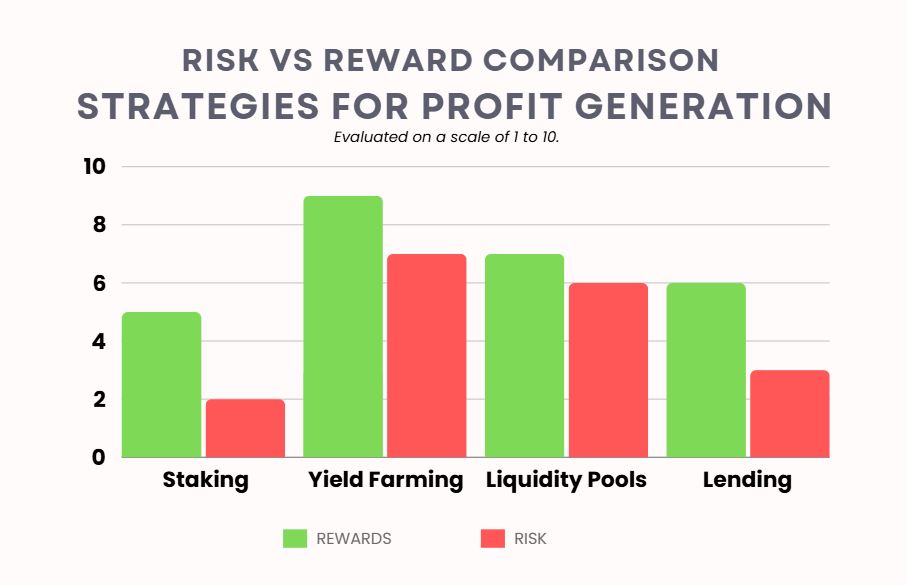

Strategies for Profit Generation :

Risk vs Reward Analysis

- Most favorable Risk/Reward Ratio: Staking (2.50), as it offers an optimal balance with low risk.

- Most stable strategy: Lending, thanks to regular returns and controlled risks.

- Riskiest strategy: Yield Farming, despite potentially high gains, due to technical complexities and risks associated with DeFi platforms.

- Intermediate option: Liquidity Pools, well-suited for traders willing to monitor temporary losses and capture profit opportunities.